Manual invoice processing wastes hours daily. Invoice OCR AI automates data extraction in seconds, saving teams up to 95% of their time on accounts payable.

The Hidden Cost of Manual Invoice Processing

Every finance team knows the pain: stacks of invoices waiting to be processed, endless hours spent manually typing vendor names, amounts, and line items into spreadsheets or accounting systems.

Manual invoice processing costs between $12.88 per invoice on average, according to Ardent Partners' 2024 research. For a company processing just 1,000 invoices monthly, that's over $150,000 annually spent on data entry alone.

The real cost goes far deeper than the price tag. Manual processing takes an average of 17.4 days per invoice to complete the full cycle from receipt to payment, compared to just 3.1 days for best-in-class automated organizations. During this time, your team is manually typing data, cross-referencing purchase orders, routing documents for approval, and correcting inevitable errors.

The error rate tells an even more concerning story. Manual data entry produces errors in approximately 2% of invoices, with each mistake costing an average of $53.50 to fix. These errors lead to late payments, strained vendor relationships, and lost early payment discounts.

While your talented finance team spends hours manually processing invoices, they're not analyzing cash flow, negotiating better terms, or contributing to strategic initiatives. They're just typing.

What is Invoice OCR AI and How Does It Work?

Invoice OCR AI is like giving your accounts payable department a tireless digital assistant that never makes typing mistakes and works at superhuman speed.

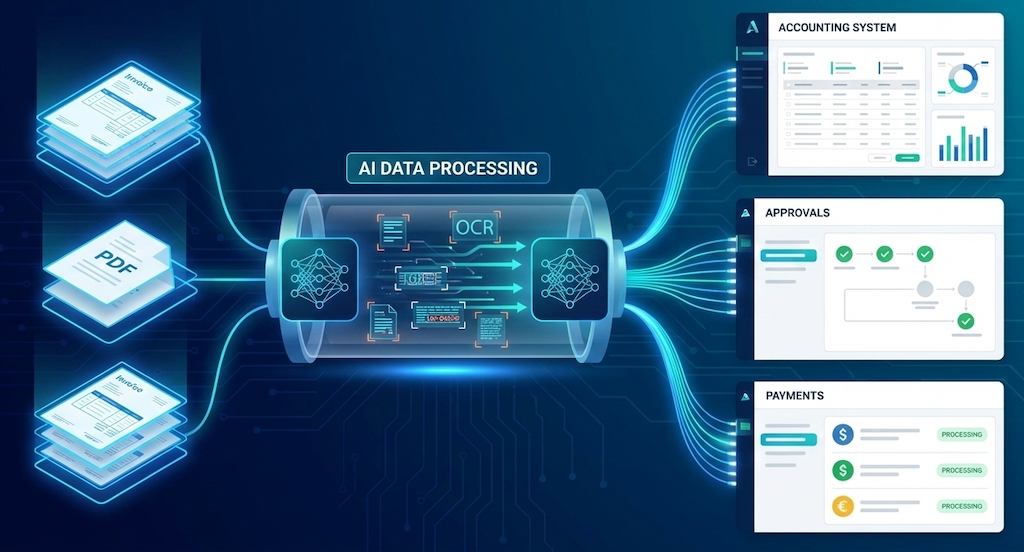

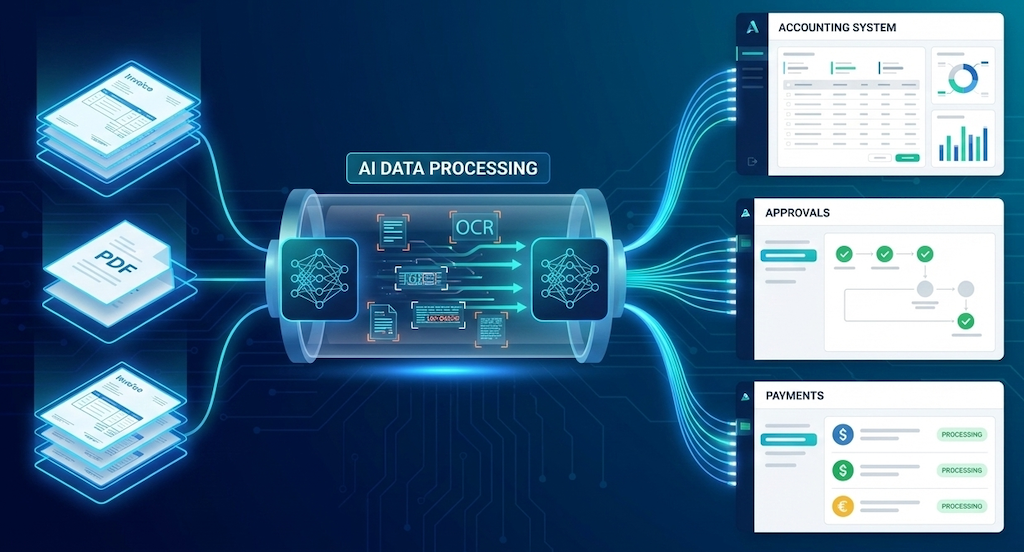

OCR stands for Optical Character Recognition—technology that "reads" text from images and PDFs. But modern invoice OCR AI goes far beyond simple text recognition. It combines artificial intelligence, machine learning, natural language processing, and computer vision to understand, extract, and validate invoice data intelligently.

Traditional OCR was basic—it could read text but couldn't understand context. Modern invoice OCR AI changes everything by learning from every invoice it processes, continuously improving its ability to handle different layouts, formats, and even handwritten notes.

How It Works:

When an invoice arrives via email, cloud storage, or direct upload, the system processes it in seconds:

- Document Capture: Receives invoices in any format—PDF, JPG, PNG, or scanned paper documents

- Image Enhancement: AI enhances quality, adjusts contrast, removes noise, and corrects rotation

- Data Extraction: OCR identifies text while AI determines what each piece represents—vendor names, invoice numbers, dates, line items, amounts, and tax details

- Validation: Cross-references extracted data against your vendor database, flags duplicates, matches to purchase orders, and identifies discrepancies

- Data Structuring: Organizes everything into structured format ready for your ERP or accounting software

- Continuous Learning: Becomes smarter with each invoice, adapting to your specific formats

This entire process happens in 0.5 to 4 seconds per document. While manual processing takes days, invoice OCR AI completes the same task faster than you can finish your morning coffee.

Manual Entry vs Invoice OCR AI: A Side-by-Side Comparison

Processing Speed:

Manual processing averages 17.4 days per invoice from receipt to payment. Invoice OCR AI slashes this to 3.1 days or less—an 80% reduction in processing time. For high-performing implementations, advanced systems can extract and validate invoice data in under 5 seconds.

Accuracy Rates:

Manual data entry produces errors in approximately 2% of invoices. In a batch of 1,000 invoices, that's 20 mistakes that need fixing at $53.50 each—over $1,000 in correction costs alone.

Modern invoice OCR AI achieves accuracy rates up to 99% for well-structured invoices. The AI also flags uncertain extractions for human review, ensuring nothing slips through the cracks.

Cost Per Invoice:

Manual processing costs $12.88 per invoice on average, while best-in-class automated teams bring that down to just $2.78—a reduction of nearly 78%. A business processing 1,000 invoices monthly can save approximately $120,000 annually just by automating.

Scalability:

Manual processing breaks down as volume increases. Want to process more invoices? You need more people. Business growing? Time to hire.

Invoice OCR AI scales effortlessly. Whether you're processing 100 or 100,000 invoices monthly, the system handles it without additional staff, overtime, or bottlenecks.

Real-World Time Savings: The 95% Efficiency Gain

The 95% time savings figure isn't marketing hype—it's backed by real data from companies seeing transformative results.

Where Time Savings Come From:

In manual processing, AP staff spend approximately 20% of their time just typing invoice information. Invoice OCR AI completely eliminates this task, with data extraction happening automatically in seconds.

Automated systems route invoices instantly to the right approvers based on predefined rules—no waiting, no lost documents, no chasing people down for signatures. With 99% accuracy and automatic validation, the hours spent hunting down mistakes and fixing incorrect entries virtually disappear.

The Numbers Don't Lie:

Research from Ardent Partners shows that automation can shorten invoice processing cycles by up to 80%. One company processing 3,500 invoices monthly reported reducing their reconciliation time from 30 minutes to 1 minute per invoice—a 96.7% reduction. That freed up approximately 1,700 hours monthly.

For a typical mid-sized company processing 1,000 invoices monthly, moving to invoice OCR AI means your AP team reclaims 100+ hours per month, processing cycles shrink from weeks to days, and early payment discounts become actually attainable.

Key Features to Look for in Invoice OCR AI Solutions

Not all invoice OCR AI solutions are created equal. Here's what separates the good from the great:

High Accuracy & Intelligent Extraction: Look for solutions offering 97-99% accuracy rates that handle multiple invoice formats, languages, and layouts. The best systems extract not just basic fields but also line-item details including product descriptions, quantities, unit prices, and tax rates.

Multi-Format Support: Your solution should accept invoices in any format—PDF, JPG, PNG, TIFF, and even handwritten documents or smartphone photos.

Seamless Integration: Look for solutions that integrate with popular accounting software (QuickBooks, Xero, Sage), ERP systems, cloud storage (Google Drive, Dropbox, OneDrive, Box), and automation tools (Zapier, Make, n8n). API and webhook support enables custom integrations.

Smart Validation & Learning: The system should automatically validate data against business rules, flag duplicates, match to purchase orders, and learn from corrections to improve over time.

Security & Compliance: Enterprise-grade encryption, compliance with regulations (GDPR, SOX), secure authentication, and complete audit trails are essential.

One Platform That Gets It Right:

SmartBills exemplifies what modern invoice OCR AI should be. The platform combines AI-powered data extraction with user-friendly design and flexible integration options. It accepts invoices from multiple sources—email, cloud storage, or direct upload—and automatically captures vendor names, amounts, dates, line items, and more with high accuracy.

SmartBills connects with Google Drive, Dropbox, Box, OneDrive, and popular automation tools, making it easy to fit into existing workflows. Whether you're a small team processing 100 invoices monthly or an enterprise handling thousands, SmartBills scales to meet your needs with plans starting at just $20/month.

The Future of Invoice OCR AI in Accounts Payable

Invoice OCR AI isn't standing still—it's evolving rapidly with exciting developments on the horizon.

Advanced AI Capabilities: Next-generation systems will handle increasingly complex invoice formats with near-perfect accuracy, understand context better than ever, adapt to new vendors instantly, and predict processing issues before they occur.

Predictive Analytics & Insights: Future solutions will predict cash flow needs based on upcoming invoices, identify spending patterns and cost-saving opportunities, flag unusual charges automatically, and recommend optimal payment timing to maximize working capital.

Enhanced Fraud Detection: AI systems will become your first line of defense, detecting altered or forged invoices, identifying unusual patterns, cross-referencing multiple data sources, and flagging suspicious vendors instantly.

Conversational AI: Natural language interfaces will make financial data accessible to everyone. Imagine asking "How much did we spend with XYZ vendor last quarter?" and getting an instant, accurate answer.

Autonomous AP: The ultimate evolution—fully autonomous AP departments where AI handles the entire invoice-to-payment process with minimal human intervention, with humans only stepping in for exceptions and strategic decisions.

The companies that adopt invoice OCR AI now won't just be ahead of the curve—they'll be ready when these next-generation features arrive.

Conclusion: Making the Switch to Automated Invoice Processing

The question isn't whether to automate your invoice processing—it's how quickly you can make it happen.

Manual invoice processing is costing your business time, money, and opportunity. With costs averaging $12.88 per invoice, processing times stretching beyond two weeks, and error rates around 2%, the inefficiency is undeniable.

Invoice OCR AI offers a clear path forward: 95% time savings, 78% cost reduction, 99% accuracy, and effortless scalability. These aren't just incremental improvements—they're transformative changes that fundamentally reshape how your finance team operates.

Your accounts payable team didn't sign up to be data entry clerks. They're financial professionals who deserve tools that let them work at the level of their expertise. Invoice OCR AI gives them exactly that—freedom from tedious manual tasks and time to focus on strategic financial management.

The technology is proven. The ROI is compelling. The time to act is now.

Ready to transform your invoice processing? Try SmartBills Free and see how AI-powered automation can save your team 95% of their time while improving accuracy and reducing costs.